Government Shut Down Affecting YOUR Mortgage?

October 1, 2013

A number of you have asked us the following question: “Hey – what’s the whole government shut down thing and how might it affect our clients and getting them a mortgage?

A number of you have asked us the following question: “Hey – what’s the whole government shut down thing and how might it affect our clients and getting them a mortgage?

- The government’s fiscal year runs from October 1 to September 30. Every year – Congress has to pass the spending bills that fund the government. If they don’t pass those spending bills – the government can’t spend any dough. Who says Congress has to approve these spending bills before the government spends money? The Constitution.

- Why won’t Congress sign next year’s spending bill? It’s a big scrap over the new health care law.

- Uh oh. Lots of things depend on government spending. Will air traffic controllers get laid off? What about the men and women in our armed forces? About 2.5 million government employees will be considered “essential.” Those people will keep on working. Air traffic controllers and military folks are in that category. But, about 800,000 employees will be considered “non-essential.” They get furloughed. (PS – Congress keeps getting paid, even if the spending bill doesn’t pass. We are so very pleased for them…)

- Will this affect the economy? It depends. If it only lasts a week or so – probably not. If it goes on longer, it could definitely have an effect on the economy – especially because we’re in a pretty fragile recovery.

- How will this affect the mortgage industry? In the short run – it won’t affect us much. In the longer run (beyond 10 days) it will start to have a more serious effect:

- FHA

- We’ll still be able to write FHA loans if the spending bill isn’t passed.

- We will still be able to get an FHA Case Number from FHA. FHA Total Scorecard will still be available.

- VA

- We’ll still be able to write VA loans if the spending bill isn’t passed.

- We’ll still be able to obtain Certificates of Eligiblity online

- Fannie and Freddie

- Both of these entities won’t be directly affected. We’ll still be able to write conventional loans.

- Sounds like we won’t be affected at all – that’s great news. What’s the problem then?

- Some things won’t work if Congress doesn’t pass the spending bill:

- IRS – they will still collect our taxes, BUT, they won’t be processing any forms – like the 4506. It’s possible that, without the tax transcripts, some processing could be delayed.

- Social Security Administration – lenders often rely on the SSA to verify social security numbers. This function could be delayed.

- FEMA (Flood Insurance) – the ability to get new policies could be delayed. This could affect purchases if the shutdown goes on for a while. Again, it will have very little effect if it only occurs for a few days.

- Some things won’t work if Congress doesn’t pass the spending bill:

- FHA

What about interest rates? If the government stops paying some of its bills – won’t interest rates go way up?

- Interestingly, at least in the short run – probably not. Why? Because nobody believes the US Government won’t ultimately pay back bond holders (that fight is coming when the borrowing limit needs to be raised on October 17th). But, because this little game of chicken that Congress is playing with themselves will potentially damage the economy – the biggest losers if this goes on for a while would be individual companies and folks like you and I. So, people who think this will go on for a while are moving money out of stocks and putting them into US Treasury bonds. Weirdly, the government saying they won’t pay their debts for a while could actually push rates lower. BUT – before a banker gets super excited and tells his/her clients to float, consider that things could get really messy if this goes on for a while and nobody knows how that will play out.

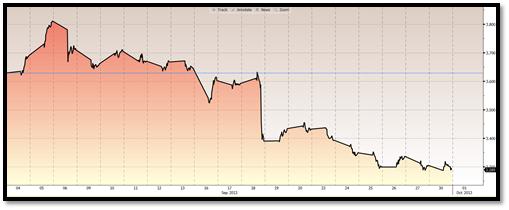

- Here’s what rates have done over the past 30 days or so heading into today’s showdown:

- So that’s it for now. There’s no reason to get too riled up over this. As mentioned, things could get more complicated if this lasts for a while. We’ll certainly provide more updates in the days to come.

Green House Mortgage is a full service home loan origination entity in Tampa, FL and servicing the state throughout. If you have any questions or concerns with the article or simply need mortgage advice please call 813-732-3155 or email us at info@ghmortgage.com. We are dedicated to giving you the best mortgage consultation available. Green House Mortgage – It Pays to Go Green!